HPP Cares 6 Month Self Employment free printable template

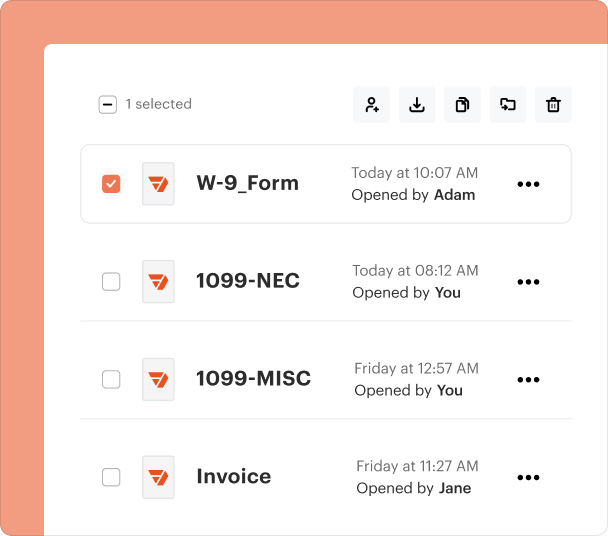

Fill out, sign, and share forms from a single PDF platform

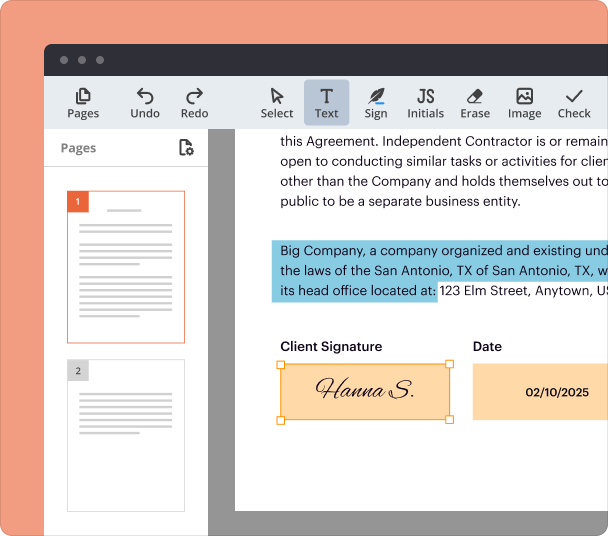

Edit and sign in one place

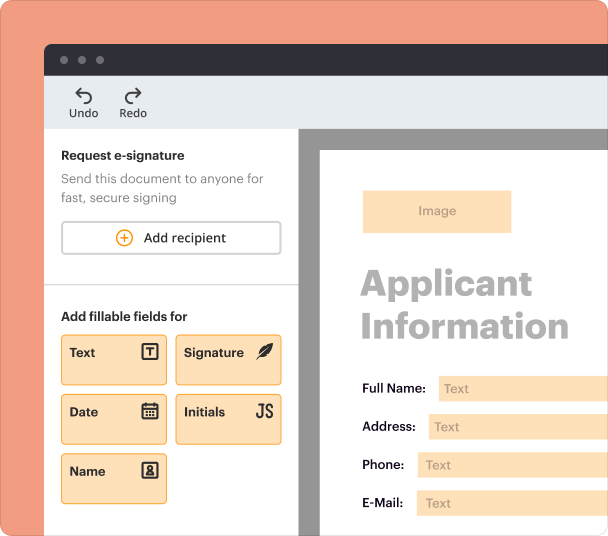

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

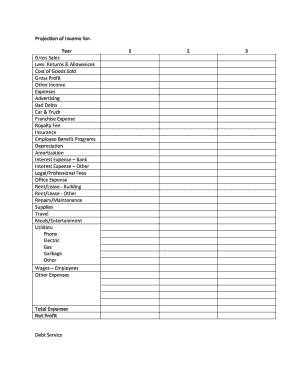

Understanding the HPP Cares 6 Month Form

Overview of the HPP Cares 6 Month Form

The HPP Cares 6 Month Form is a critical document used primarily by individuals in self-employment situations or those seeking assistance through the HPP program. This form gathers essential information to determine eligibility and the level of support required.

Key Features of the HPP Cares 6 Month Form

This form includes sections that capture personal details, income levels, and employment status. Notable features are its straightforward format, allowing for easy input of data, and a section for required signatures, facilitating quick processing by agencies.

When to Use the HPP Cares 6 Month Form

Individuals should use the HPP Cares 6 Month Form whenever they need to report their self-employment income or apply for financial assistance related to health coverage. Timely submission is crucial to avoid gaps in support and ensure continued eligibility.

Eligibility Criteria for the HPP Cares 6 Month Form

To be eligible for assistance via the HPP Cares program, applicants typically need to demonstrate a specific level of self-employment income and meet the residency requirements set forth by the relevant authorities. Detailed income verification may be necessary.

How to Fill Out the HPP Cares 6 Month Form

Filling out the HPP Cares 6 Month Form involves providing accurate personal information, documenting your self-employment income, and ensuring all sections are completed. It is advisable to review the form thoroughly before submission to avoid delays.

Best Practices for Accurate Completion

For optimal accuracy when completing the HPP Cares 6 Month Form, individuals should double-check all entries against their financial records. Keeping copies of submitted documents and maintaining a checklist can help ensure compliance and ease any future inquiries.

Common Errors and Troubleshooting

Some common errors when completing the HPP Cares 6 Month Form include omitting required fields, inaccurate income reporting, and failure to sign the document. Being aware of these pitfalls can aid in avoiding unnecessary delays and complications during processing.

Frequently Asked Questions about monthly profit and loss statement form

What is the purpose of the HPP Cares 6 Month Form?

The purpose of the HPP Cares 6 Month Form is to gather necessary information for assessing eligibility and financial assistance for individuals who are self-employed.

How do I ensure my HPP Cares 6 Month Form is completed correctly?

Ensure accuracy by reviewing all sections, keeping a checklist of required information, and comparing entries against your financial records.

pdfFiller scores top ratings on review platforms